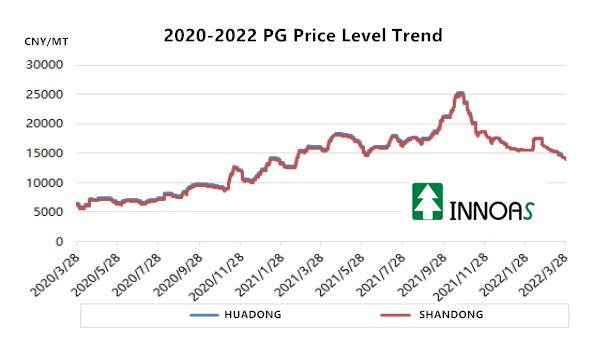

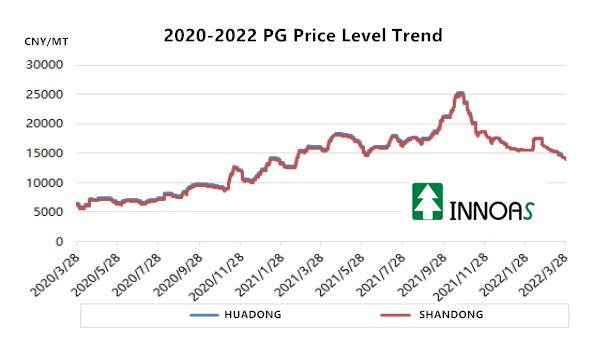

In the past 22 years, the domestic propylene glycol market rose first and then fell, ending with a decline as a whole. The first quarter is coming to an end, and propylene glycol may end in a downward trend, especially in March when the epidemic returned, and due to the conflict between Russia and Ukraine, the export orders of factories decreased, and the price of propylene glycol continued to decline. Taking Shandong as an example, the high point in this quarter was around 17,500 yuan/ton in mid-February, and the low point was around 14,000 yuan/ton at the end of March. The price difference between high and low prices was 3,500 yuan/ton. Downtrend, down 12.5%. What is the trend in the second quarter, detailed analysis is as follows.

2020-2022 Propylene Glycol Market Price Chart

From the perspective of raw materials, the propylene oxide market fluctuated within a range in the first quarter, with prices fluctuating around 11,000-12,000 yuan / ton, and operating in a low range for most of the 22 years. Strong, the market quickly stopped rising and fell. After the rise of cyclopropane, it mostly depends on the strengthening of the cost side. It is difficult for the actual demand side to have heavy volume, and after repeated hard rises, the stimulating effect of rigid demand weakens, and the rising trend gradually slows down the driving force of downstream and terminal replenishment. In addition, under the influence of the epidemic, the construction and logistics of cyclopropane, polyether and the terminal market were restricted. In the near future, the local construction of cyclopropane is still low, but the price of liquid chlorine is low, and the demand is difficult to pick up.

From the perspective of the supply side, after the Spring Festival, the propylene glycol industry has resumed operations one after another. At present, the industry has started relatively well, about 80%. In addition, under the influence of local epidemics, shipments have been blocked, and the supply in the field is relatively loose. However, some factories are expected to be overhauled in early April, and the start of construction may decline by then.

From the demand side, the current downstream flexible foam polyether range is mainly negotiated, the terminal demand continues to be weak, the polyether factory has a lack of shipments, and there is a bearish expectation in the future. In addition, Shandong was partially unblocked, the polyether industry has resumed construction, and the overall supply side is abundant; under the situation of poor shipments, the purchase intention of propylene glycol is not good. In addition, in terms of unsaturated resins, crude oil fluctuates frequently at high levels, and some resin raw materials fluctuate strongly under the support of cost. However, it is difficult for the terminal marble and related real estate industries to improve significantly in a short period of time. The UPR market continued to organize in a range, and the demand for propylene glycol was also flat. In addition, under the conflict between Russia and Ukraine, pg export orders decreased. Overall, the demand side of propylene glycol is flat.

Comprehensive analysis shows that the propylene glycol industry is currently operating at a sufficient level, and some parts are still affected by the epidemic, and the supply side tends to be loose. The demand side is flat; raw material po stocks are expected to decline. However, individual devices are expected to be overhauled. As the price of propylene glycol falls to a low level, the decline will be limited. It is expected that the domestic propylene glycol market will fluctuate at a low level in the short term. However, if the domestic epidemic is brought under control and the international situation improves, the propylene glycol market may be expected in the second quarter. Continue to pay attention to the epidemic situation and supply and demand.